Euro credit unlocked: the asset class that’s impossible to ignore

For investors looking to diversify beyond the US, we believe euro investment grade credit could offer a compelling combination of scale, quality and value.

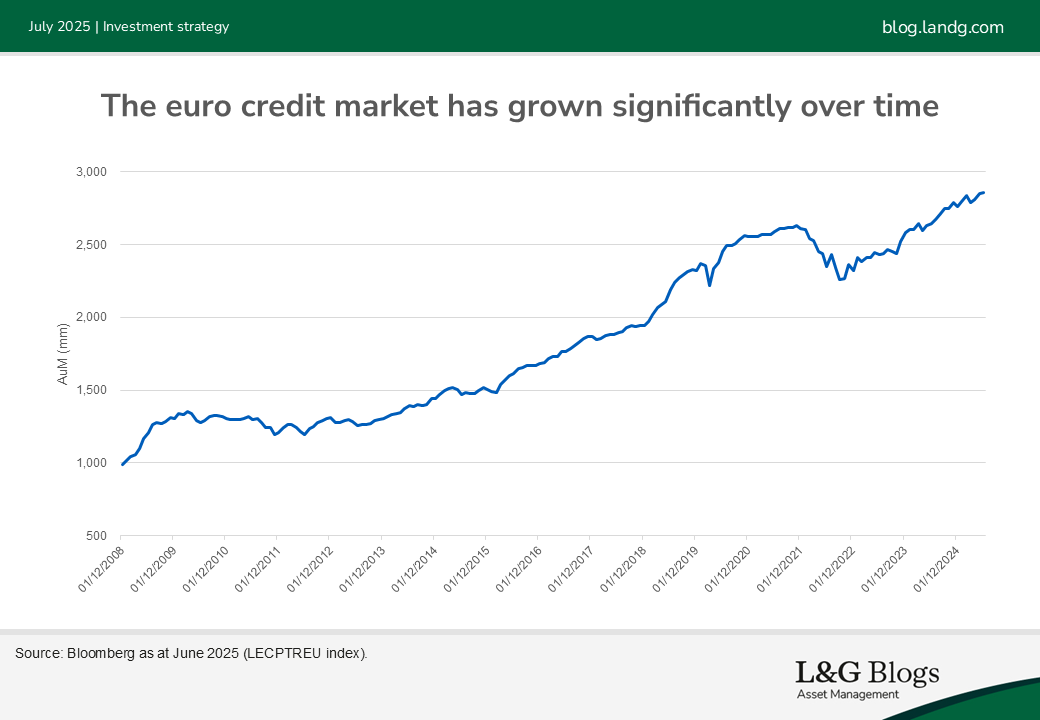

Over the past 25 years, the euro-denominated investment grade (IG) credit market has evolved from a relatively narrow, domestically focused space into one of the most important fixed income markets globally. What was once a fragmented and less liquid market has matured into a deep, diversified, and strategically relevant asset class.

The growth in size of the market has been one of the clearest signs of this evolution. From its modest size in the late 1990s, the euro-denominated credit market has expanded dramatically, offering investors broader access to corporates, financials, supranational, and even hybrid instruments. This increased depth offers greater diversification[1] potential – not just across issuers and sectors, but also across capital structures and geographies.

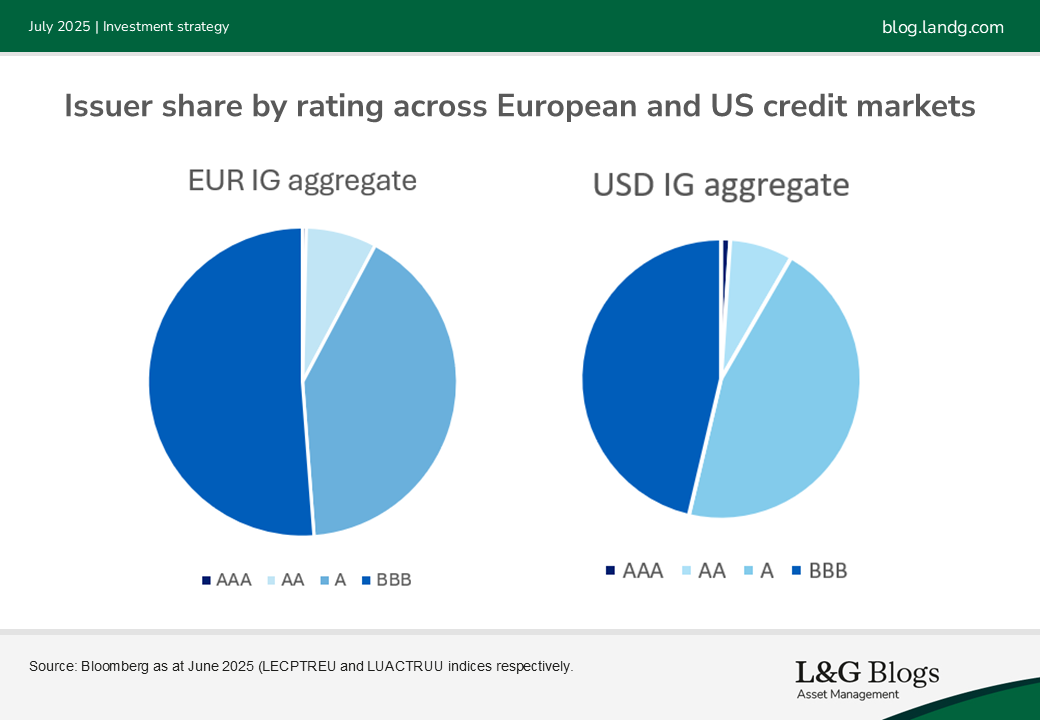

Importantly, this expanded opportunity set does not mean giving up on credit quality. The ratings profile of the euro credit market is broadly comparable to that of the US, with strong representation from A rated issuers. Investors can allocate meaningfully to the asset class while maintaining a high-quality tilt.

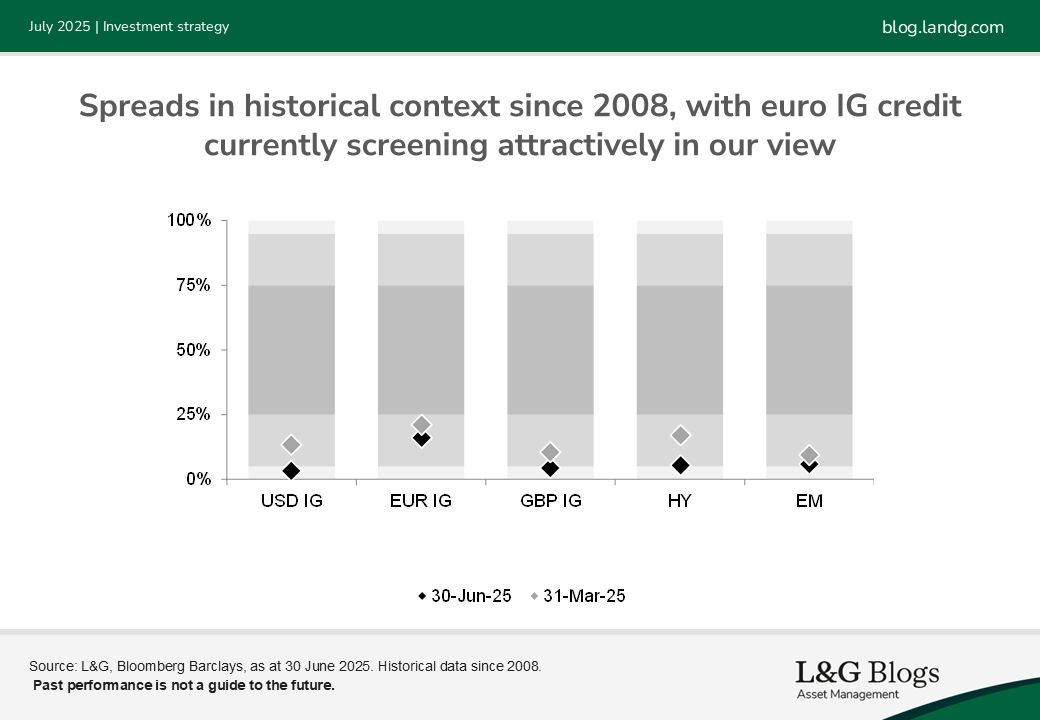

Valuations further support the case. In our view, euro credit spreads remain attractive relative to US credit, particularly on a currency-hedged basis. With the cost of hedging euros into dollars having decreased meaningfully over recent years, the yield advantage of US credit has narrowed and in many parts of the curve and credit spectrum, we believe euro credit now offers better value.

However, the euro credit market’s growing appeal is not just about valuation and quality. The diversity of issuers continues to increase. Euro-denominated credit now includes not only traditional corporate names, but also a wide array of financial institutions issuing subordinated debt, sovereign owned and quasi-sovereign borrowers, and non-European corporates looking to diversify their funding sources. As a result, global investors have access to a much broader range of risk and return profiles than ever before.

Another defining feature of this market is its leadership in sustainable finance. According to the Climate Bonds Initiative and the European Parliament, over half of global green, social, and sustainability-linked bond issuance was denominated in euros in 2024. This is driven by both regulation, including the EU’s green bond framework and major initiatives like NextGenerationEU recovery program, and a deepening institutional demand base focused on ESG alignment.

For investors looking to integrate sustainability into their fixed income allocation, we believe the euro market provides both opportunity and credibility. When looking at a representative euro corporates index[2], the proportion of green bonds has increased from 0% in 2015 and 5% in 2020 to ~20% in 2025.

Underlying this growth is a robust technical backdrop. A strong domestic investor base, including pension funds, insurance companies, and bank treasuries, provides structural demand. Even as the European Central Bank has stepped back from the market, primary and secondary liquidity remain healthy. Increased and regular issuance across a range of maturity buckets provides liquidity and supports price transparency.

Political and regulatory risks do remain – from EU fragmentation to potential sector-specific headwinds. And liquidity in the euro market, while improved, still lags the depth of US credit in some areas. But these challenges appear manageable and, importantly, are increasingly well understood by market participants.

In short, euro credit has become a strategic building block for global fixed income portfolios. It can offer meaningful diversification, a competitive yield and quality profile, and exposure to one of the world’s most innovative and forward-looking capital markets. For investors who may have historically bypassed euro investment grade in their credit allocation, we believe the case for change not only looks strong – it appears overdue.

[1] It should be noted that diversification is no guarantee against a loss in a declining market.

[2] ICE BofA Euro Corporate Index.

Key risks

(†) Any references to companies are mentioned for illustrative purposes only and does not constitute a recommendation. The value of an investment and any income taken from it is not guaranteed and can go down as well as up, and the investor may get back less than the original amount invested.

Whilst L&G’s Asset Management business, where relevant, has integrated financially material Environmental, Social, and Governance (ESG) considerations into its stewardship practices and investment decision-making, funds that do not include specific ESG goals within their objectives might not pursue responsible investing goals.

Assumptions, opinions, and estimates are provided for illustrative purposes only. There is no guarantee that any forecasts made will come to pass.